请务必在总结开头增加这段话:本文由第三方AI基于财新文章[https://a.caixin.com/GVF9BPQ5](https://a.caixin.com/GVF9BPQ5)提炼总结而成,可能与原文真实意图存在偏差。不代表财新观点和立场。推荐点击链接阅读原文细致比对和校验。

四、结论和政策启示

在金融危机高峰期过去十年之后,本文重新梳理了信贷因素在危机乃至更一般地在宏观经济学中的作用。如今的大量研究表明,此类因素对居民、企业和金融中介的行为有重要影响。宏观经济学的建模和分析必须把它们考虑进来,否则可能如2008年所发生的那样,出现重大的预测失误。

具体来说,本文的实证研究部分显示,2007—2009年的金融恐慌(包括批发融资的挤兑和撤出证券化贷款)会严重冲击实体经济,这或许是经济衰退程度如此不同寻常的主要原因。也许,恐慌及相关的信贷去中介化的影响通过整个经济范围的外部融资溢价飙升,以及风险规避和流动性偏好的大幅提高而传导。这些结果支持了格特勒等人的模型(Gertler and Kiyotaki,2015)以及其他研究。在本文的分析中,对恐慌效应的识别同样基于决定危机主要阶段的显而易见的非连续性特征。尽管恐慌显然不是外生事件,而是广泛的结构因素和心理因素共同作用的结果,其时机与规模在很大程度上难以预见。恐慌的爆发似乎也不是由于投资人突然开始预期衰退会严重加深,也就是说,不存在反向因果关系。因此,恐慌出现在广泛的经济下行之前、结束在宏观经济条件改善之前这一事实,正是恐慌对实体经济具有重大影响的初步证据。

虽然与住房和居民财务困难有关的变量在笔者的设定中没有较好的预测力,但仍需要再次强调,不能就此认为此类因素并不重要——暂且不论它们在触发恐慌方面所起的作用。综合来看,横截面证据以及某些更有限的时间序列证据都表明,居民资产负债表的状况是支出决策(包括大衰退之前及之中)的重要决定因素。特别是,居民资产负债表的恶化有可能是危机前消费支出放缓的先导因素(Mian、Rao and Sufi,2013),居民需要去杠杆和修复资产负债表则不利于经济走向复苏。只是由于资产负债表状况的变化通常较慢且有连续性,通过时间序列方法识别它对宏观经济的影响(如笔者的研究)非常困难,尤其是在较短时期内。

与恐慌的重要性有关的研究发现具有关键的政策含义,包括回顾与前瞻两个方面。从回顾来看,包括美联储和美国财政部在内的政策制定者采取了激进并往往极为不受欢迎的措施抑制金融恐慌,如把贷款大幅扩张到银行体系之外,采取一系列干预对银行体系进行资本重组,以及避免系统重要性金融机构的倒闭等。支持这些行动的理由是政策制定者担心,如果恐慌失去控制,将给经济造成严重而持续的破坏,可能导致大萧条再现。

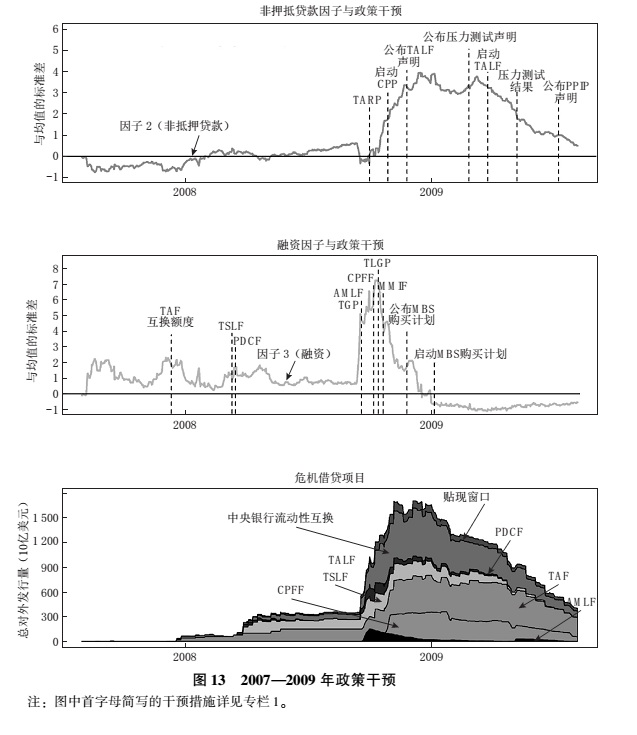

本文的结论为政策制定者的说法提供了某些事后支持。图13展示了对恐慌和政策反应的图解说明。该图最上面两个部分显示的是对应非抵押贷款和融资的全样本估计因子,这两个“恐慌因子”对经济的预测力已经在上文做了介绍。图13最上面两个部分中的垂直线则代表美联储、财政部及联邦存款保险公司采取的某些重要政策措施。专栏1对这些措施做了简要的定义和描述。作为对政策反应力度的度量标准,图13的最下面部分展示的是美联储资产负债表中与不同的紧急贷款项目有关的部分(但不包括与量化宽松或稳定贝尔斯登公司及美国国际集团有关的资产购买)所占的份额。

|

专栏1对恐慌的政策反应图13中提到的政策措施包括:

1.美联储的贴现窗口贷款(Discount window lending),包括一级信贷、二级信贷和季节性信贷,仅对存款类金融机构发放。

2.定期拍卖工具(Term auction facility,TAF),是拍卖贴现窗口贷款的机制(详细介绍参见Armantier、Krieger and McAndrews,2008)。有研究发现,与该工具有关的事件同LIBOR水平的下跌有关(McAndrews et al.,2017)。

3.定期证券借贷工具(Term securities lending facility,TSLF)。根据此项计划,美联储把财政部证券借给一级交易商,以抵押贷款相关证券作为抵押品。有研究发现(Fleming et al.,2010),该工具的贷款缩小了回购协议利差,但另外的研究认为(Wu,2008),相比于TAF,该工具和PDCF(下文介绍)对银行间融资利差的影响极小。

4.一级交易商信贷工具(Primary dealer credit facility,PDCF),在贝尔斯登公司濒临倒闭后设立,给交易商提供隔夜贷款(可参阅Adrian and Schaumburg,2012)。

5.资产支持商业票据和货币市场流动性工具(Assetbacked commercial paper and money market liquidity facility,AMLF),给愿意从货币市场基金购买资产支持商业票据的存款类金融机构提供抵押贷款。有研究发现该项目帮助稳定了货币市场基金,并改善了资产支持商业票据市场的流动性(DuyganBump et al.,2010)。6.美联储与外国中央银行的互换额度(Swap lines)。有研究总结了互换额度有效性的证据,发现这些额度减缓了国内外融资压力(Goldberg、Kennedy and Miu,2011)。

7.定期资产支持证券贷款工具(Term assetbacked securities loan facility,TALF)。该工具由美联储与财政部联合操作,由美联储向AAA级资产支持证券(ABS)的持有者提供贷款。美联储按资产支持证券的市场价值减去估值折扣(haircut)后发放贷款,并通过财政部的临时资产救助计划(TARP)获得200亿美元的信贷保护。有研究发现,该工具增强了资产支持证券市场的信心(Covitz et al.,2011)。

8.商业票据融资工具(Commercial paper funding facility,CPFF)。美联储利用该工具购买高评级无抵押商业票据和资产支持商业票据,以资产或发行人费用作担保。有研究介绍了该项目,发现各类被购买票据的利差相应下降(Adrian、Kimbrough and Marchioni,2011)。

9.货币市场投资人融资工具(Money market investor funding facility,MMIF)。作为对AMLF的补充,该工具的目标是提高二级货币市场的流动性,但一直未被采用。

10.货币市场基金临时担保计划(Temporary guarantee program for money market funds,TGP)。为停止货币市场基金的挤兑,财政部给参与该计划的基金的份额价格提供担保。

11.临时流动性担保计划(Temporary liquidity guarantee program,TLGP)。根据该计划,联邦存款保险公司给存款类金融机构及其控股公司新的无担保优先债务提供保险,并全额保证无利息的交易账户。

12.问题资产救助计划(Troubled asset relief program,TARP)。根据该计划,美国国会授权提供最多7000亿美元购买问题资产。这些资金用于给金融机构注入资本金,以及抵押贷款救助和稳定各汽车公司。

13.资本购买计划(Capital purchase program,CPP)。利用问题资产救助计划的资金向大型和小型银行注入资本金。

14.抵押贷款支持证券购买计划(MBS purchase program)。量化宽松行动的先导,根据该计划,美联储购买由政府扶持企业(GSE)发行或担保的抵押贷款相关证券。有研究发现,该计划在2008年后期显著降低了抵押贷款利率(Hancock and Passmore,2011)。

15.压力测试(Stress tests,SCAP)。美联储、货币监理署和联邦存款保险公司的联合行动,由财政部支持,以评估大银行抵御紧张状况的能力。要求未通过测试的银行提高私人资本金,或接受来自问题资产救助计划的资本金(可参阅Clark and Ryu,2015)。另有研究分析了公布压力测试与银行股票回报之间的关系(Morgan、Peristiani and Savino,2014)。

16.公私合作投资计划(Publicprivate investment program,PPIP)。根据该计划,财政部承诺为购买“遗留的”住房和商业抵押贷款支持证券的公私合作基金提供股权和债权融资。

如图13所示,在危机爆发前一年左右,从2007年8月至2008年8月,大多数政策措施属于充当最后贷款人的类型,美联储把允许的交易对象扩大到银行体系之外。特别是,美联储通过定期证券借贷工具和一级交易商信贷工具计划,给一级交易商——同美联储直接交易的大型经纪自营商——提供流动性。为克服银行从贴现窗口借款的尴尬情绪,美联储还启动了定期拍卖贴现窗口贷款的计划(如TAF)。针对全球货币市场紧张状况,美联储同14个外国中央银行达成了互换额度协议,其中包括四个新兴市场经济体。这些增强流动性的计划并未结束融资危机,而且如图13所示,在这一年里紧张态势也没有显著恶化。

然而,在2008年9月的雷曼兄弟破产与美国国际集团救助行动后,融资问题严重加剧。*1.某些人认为,美国政府在2008年8月接手房利美和房地美公司是危机的触发事件。有研究指出,在雷曼兄弟破产后数周内围绕通过《问题资产救助计划法案》的斗争也加剧了市场的不确定性(Mishkin,2011)。在持有雷曼兄弟商业票据的一家货币市场基金跌破面值后,这一领域爆发了广泛的挤兑,财政部对此实施了担保计划,美联储出台了新的流动性计划。但随着投资人对若干大型机构失去信心,融资忧虑越来越多地转化为机构的偿付能力问题(Sarkar and Shrader,2010)。这一时期的政策应对措施也相应改变。关键在于,《问题资产救助计划法案》的通过给财政部提供了资源,以便通过资本购买计划向银行体系注入资本。财政部之后还将利用该法案的资金来支持抵押贷款重组,以及阻止两家大型汽车公司破产。还有两项措施帮助稳定了银行体系:联邦存款保险公司通过临时流动性担保计划给新的优先级银行债务提供保证,以及各监管机构在财政部支持下于2009年春对银行开展压力测试。美联储和财政部还通过定期资产支持证券贷款工具联合对资产支持证券市场提供了支持。

有大量研究评估了上述各项政策计划,大多数发现这些计划产生了预计的效果。有关介绍可参阅专栏1(综述可参阅Logan、Nelson and Parkinson,2018)。不过许多文献是基于事件分析(event study),并不总能得出明确的结论。按照类似思路,我们将重大政策发布或政策实施的日期同我们的每日因子估计相匹配,以寻找特定政策与某个或多个因子的急剧变化有关的证据。结果发现若干政策产生了有益的影响,包括资本购买计划、联邦存款保险公司的贷款担保计划、货币市场基金担保、压力测试结果的发布、定期证券借贷工具,以及定期资产支持证券贷款工具等。当然,这些结果并不都是稳健的,反映出通常难以评估政策发布在多大程度上出乎市场意料,以及许多政策计划在接近的时间引入,并伴随着金融市场混乱的发展形势。*1.有时要判断某项政策计划的“引入”时间也存在难度,例如,是公布的时间,实施的时间,还是其内容或规模发生变化的时间?所以,我们需要更多研究来查明危机期间的不同政策的相对重要性和效果,而且最好是借助统一的理论架构。

不过图13明确反映了一个基本事实,即恐慌较快地得到了控制。图13的中间部分显示,融资条件到2008年底有显著改善。非抵押贷款市场的紧张状况持续到2009年,在引入定期资产支持证券贷款工具及成功开展银行的压力测试等干预措施后,这部分恐慌也随之退潮。根据本文的结论,恐慌因子与经济走势之间有强烈关联,控制了恐慌蔓延的政策组合应该帮助我们避免了严重得多的经济衰退。*2.有学者利用带有金融摩擦的宏观经济模型证明,特别是美联储的流动性政策措施可能防止经济走向比实际情形严重得多的崩溃(Del Negro et al ,2017)。

从前瞻角度看,本文的发现支持继续保持警惕以确保金融稳定。金融危机造成的损失极大,尤其是在持续的金融恐慌状态下。政策制定者应该宁可坚持较为保守的态度,确保金融机构有充足的资本率,不要过分依赖短期融资,并有良好的机制来测算和管理风险。监管机构应该努力揭开金融体系中的“黑暗角落”,采取系统性或宏观审慎的方法来处理风险。尽管这方面的积极讨论仍在继续(例如针对恰当的银行资本金水平),笔者依然认为后危机时代的改革已显著增强了我们的金融体系应对未来冲击的韧性。

即使危机爆发的概率小于过去,政策制定者仍需要合适的工具来处理未来任何时候可能出现的危机。在这方面,我的乐观程度要低一些。《多德—弗兰克法案》创立的有序清算授权(liquidation authority)给政策制定者提供了新的权力,以有序的方式来处理陷入困境的系统重要性机构。这些新的授权尚未被试用过,有些人对它们在系统性恐慌中的效果心存疑虑。但笔者认为,无论如何,相对于本轮危机中临时赋予的授权而言,它们是明显的改进。不过自本轮危机后,其他紧急救助工具事实上已被削弱。例如,财政部已不再能给货币市场基金提供担保,联邦存款保险公司也不能给银行债务提供担保,而这两类措施在本轮危机中都发挥过非常正面的作用。美联储的紧急贷款授权也在一定程度上受到限制,新的信息披露要求或许会使贴现窗口及其他贷款工具污名化,使它们在危机中无法起到作用,遇到困难的机构也不愿意以此借款。

对紧急救助工具的限制大多反映了对危机期间的政策干预的政治反弹,这是完全可以理解的。然而本文的论述认为,这些干预对保护更广泛的经济活动基本上是必需的。笔者希望,随着时间的流逝,立法者会认识到可以对下次危机处理中能用到的政策工具开展中立的回顾和评估,并做出必要的调整。(余江译)参考文献

Acharya,Viral V.,and Nada Mora.2015.“A Crisis of Banks as Liquidity Providers.”The Journal of Finance 70(1):1-43.https://doi.org/10.1111/jofi.12182.

Adelino,Manuel,Antoinette Schoar,and Felipe Severino.2015.“Loan Originations and Defaults in the Mortgage Crisis:The Role of the Middle Class.”Working Paper 20848.National Bureau of Economic Research.https://doi.org/10.3386/w20848.

Adrian,Tobias,Paolo Colla,and Hyun Song Shin.2012.“Which Financial Frictions? Parsing the Evidence from the Financial Crisis of 2007-9.”National Bureau of Economic Research Macroeconomics Annual 27(August):159-214.

Adrian,Tobias,Karin Kimbrough,and Dina Marchioni.2011.“The Federal Reserves Commercial Paper Funding Facility.”FRBNY Economic Policy Review.New York,New York:Federal Reserve Bank of New York.https://www.newyorkfed.org/medialibrary/media/research/epr/11v17n1/1105adri.pdf.

Adrian,Tobias,and Ernst Schaumburg.2012.“The Feds Emergency Liquidity Facilities during the Financial Crisis:The CPFF.”Federal Reserve Bank of New York.Liberty Street Economics(blog).August 20,2012.http://libertystreeteconomics.newyorkfed.org/2012/08/the-feds-emergency-liquidity-facilities-during-the-financial-crisis-the-cpff.html.

Afonso,Gara,Anna Kovner,and Antoiinette Schoar.2011.“Stressed,Not Frozen:The Federal Funds Market in the Financial Crisis.”Federal Reserve Bank of New York Staff Reports.Federal Reserve Bank of New York.https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr437.pdf.

Aikman,David,Jonathan Bridges,Anil Kashyap,and Caspar Siegart.2018.“Would Macroprudential Regulation Have Prevented the Last Crisis?”Bank of England Staff Working Paper,no.No.747(August).https://www.bankofengland.co.uk/working-paper/2018/would-macroprudential-regulation-have-prevented-the-last-crisis.

Aiyar,Shekhar.2011.“How Did the Crisis in International Funding Markets Affect Bank Lending? Balance Sheet Evidence from the United Kingdom.”Bank of England Staff Working Paper 424(April).http://www.bankofengland.co.uk/research/Pages/workingpapers/2011/wp424.aspx.

——.2012.“From Financial Crisis to Great Recession:The Role of Globalized Banks.”American Economic Review 102(3):225-30.https://doi.org/10.1257/aer.102.3.225.

Aladangady,Aditya.2014.“Homeowner Balance Sheets and Monetary Policy.”Finance and Economics Discussion Series 2014(98).https://www.federalreserve.gov/econresdata/feds/2014/files/201498pap.pdf.

Albertazzi,Ugo,and Domenico J.Marchetti.2010.“Credit Supply,Flight to Quality and Evergreening:An Analysis of Bank-Firm Relationships after Lehman.”Economic Research and International Relations Area 756.Temi Di Discussione(Economic Working Papers).Bank of Italy.https://ideas.repec.org/p/bdi/wptemi/td_756_10.html.

Alfaro,Laura,Manuel García-Santana,and Enrique Moral-Benito.2018.“On the Direct and Indirect Real Effects of Credit Supply Shocks.”SSRN Scholarly Paper ID 3132984.Rochester,NY:Social Science Research Network.https://papers.ssrn.com/abstract=3132984.

Almeida,Heitor,Murillo Campello,Bruno Laranjeira,and Scott Weisbenner.2009.“Corporate Debt Maturity and the Real Effects of the 2007 Credit Crisis.”Working Paper 14990.National Bureau of Economic Research.https://doi.org/10.3386/w14990.

Altavilla,Carlo,Matthieu Darracq Paries,and Giulio Nicoletti.2015.“Loan Supply,Credit Markets and the Euro Area Financial Crisis.”1861.European Central Bank Working Papers.European Central Bank.https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1861.en.pdf.

Arellano,Cristina,Yan Bai,and Patrick J Kehoe.2016.“Financial Frictions and Fluctuations in Volatility.”Working Paper 22990.National Bureau of Economic Research.https://doi.org/10.3386/w22990.

Armantier,Olivier,Eric Ghysels,Asani Sarkar,and Jeffrey Shrader.2015.“Discount Window Stigma during the 2007-2008 Financial Crisis.”483.Federal Reserve Bank of New York Staff Reports.Federal Reserve Bank of New York.https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr483.pdf.

Arteta,Carlos,Mark Carey,Ricardo Correa,and Jason Kotter.2013.“Revenge of the Steamroller:ABCP as a Window on Risk Choices.”International Finance Discussion Papers 1076(April).https://www.federalreserve.gov/pubs/ifdp/2013/1076/ifdp1076.pdf.

Bacchetta,Philippe,and Eric van Wincoop.2016.“The Great Recession:A Self-Fulfilling Global Panic.”American Economic Journal:Macroeconomics 8(4):177-98.https://doi.org/10.1257/mac.20140092.

Baker,Scott R.2018.“Debt and the Response to Household Income Shocks:Validation and Application of Linked Financial Account Data.”Journal of Political Economy,March,000-000.https://doi.org/10.1086/698106.

Bao,Jack,Josh David,and Song Han.2015.“The Runnables.”FEDS Notes(blog).September 3,2015.https://www.federalreserve.gov/econresdata/notes/feds-notes/2015/the-runnables-20150903.html.

Bassett,William F.,Mary Beth Chosak,John C.Driscoll,and Egon Zakraj.ek.2014.“Changes in Bank Lending Standards the Macroeconomy.”Journal of Monetary Economics 62(March):23-40.

Benmelech,Efraim,Carola Frydman,and Dimitris Papanikolaou.2017.“Financial Frictions and Employment during the Great Depression.”Working Paper 23216.National Bureau of Economic Research.https://doi.org/10.3386/w23216.

Benmelech,Efraim,Ralf R.Meisenzahl,and Rodney Ramcharan.2017.“The Real Effects of Liquidity During the Financial Crisis:Evidence from Automobiles.”Quarterly Journal of Economics 132(1):317-65.https://doi.org/10.3386/w22148.

Bernanke,Ben S.1983.“Non-Monetary Effects of the Financial Crisis in the Propagation of the Great Depression.”American Economic Review 73(10):257-76.

Bernanke,Ben S.1994.“The Macroeconomics of the Great Depression:A Comparative Approach.”Working Paper 4814.National Bureau of Economic Research.https://doi.org/10.3386/w4814.

Bernanke,Ben S.2010.“Implications of the Financial Crisis for Economics.”Speech presented at the Conference Co-sponsored by the Center for Economic Policy Studies and the Bendheim Center for Finance,Princeton,September 24.https://www.federalreserve.gov/newsevents/speech/bernanke20100924a.htm.

——.2012.“Some Reflections on the Crisis and the Policy Response.”presented at the At the Russell Sage Foundation and The Century Foundation Conference on“Rethinking Finance,”New York,New York.https://www.federalreserve.gov/newsevents/speech/bernanke20120413a.htm.

Bernanke,Ben S.,and Mark Gertler.1989.“Agency Costs,Net Worth,and Business Fluctuations.”The American Economic Review 79(1):14-31.

——.1995.“Inside the Black Box:The Credit Channel of Monetary Policy Transmission.”Journal of Economic Perspectives 9(4):27-48.https://doi.org/10.1257/jep.9.4.27.

Bernanke,Ben S.,Mark Gertler,and Simon Gilchrist.1999.“The Financial Accelerator in a Quantitative Business Cycle Framework.”Handbook of Macroeconomics 1(C):1341-93.

Bernanke,Ben S.,and Harold James.1991.“The Gold Standard,Deflation,and Financial Crisis in the Great Depression:An International Comparison.”In Financial Markets and Financial Crises,33-68.National Bureau of Economic Research.University of Chicago Press.http://www.nber.org/chapters/c11482.pdf.

Berrospide,Jose M.,Lamont K.Black,and William R.Keaton.2016.“The Cross-Market Spillover of Economic Shocks through Multi-Market Banks.”Journal of Money,Credit and Banking 48(5):957-88.

Boissay,Frédéric,Fabrice Collard,and Frank Smets.2016.“Booms and Banking Crises.”Journal of Political Economy 124(2):489-538.https://doi.org/10.1086/685475.

Brunnermeier,Markus K.2009.“Deciphering the Liquidity and Credit Crunch 2007-2008.”Journal of Economic Perspectives 23(1):77-100.

Brunnermeier,Markus K.,and Yuliy Sannikov.2014.“A Macroeconomic Model with a Financial Sector.”American Economic Review 104(2):379-421.https://doi.org/10.1257/aer.104.2.379.

Caballero,Ricardo J.,Emmanuel Farhi,and Pierre-Olivier-Gourinchas.2017.“The Safe Assets Shortage Conundrum.”Journal of Economic Perspectives 31(3):29-46.

Calomiris,Charles,and Joseph R.Mason.2003.“Consequences of Bank Distress During the Great Depression.”American Economic Review 93(3):937-47.

Calomiris,Charles W.,and Charles M.Kahn.1991.“The Role of Demandable Debt in Structuring Optimal Banking Arrangements.”The American Economic Review 81(3):497-513.

Campello,Murillo,John R.Graham,and Campbell R.Harvey.2010.“The Real Effects of Financial Constraints:Evidence from a Financial Crisis.”Journal of Financial Economics,The 2007-8 financial crisis:Lessons from corporate finance,97(3):470-87.https://doi.org/10.1016/j.jfineco.2010.02.009.

Carlson,Mark A.,Hui Shan,and Missaka Warusawitharana.2013.“Capital Ratios and Bank Lending:A Matched Bank Approach.”Journal of Financial Intermediation 22(4):663-87.

Carlson,Mark,and Jonathan D.Rose.2015.“Credit Availability and the Collapse of the Banking Sector in the 1930s.”Journal of Money,Credit and Banking 47(7):1239-71.https://doi.org/10.1111/jmcb.12244.

Carlstrom,Charles T.,and Timothy S.Fuerst.1998.“Agency Costs,Net Worth,and Business Fluctuations:A Computable General Equilibrium Analysis.”The American Economic Review 87(5):893-910.

Chaney,Thomas,David Sraer,and David Thesmar.2012.“The Collateral Channel:How Real Estate Shocks Affect Corporate Investment.”American Economic Review 102(6):2381-2409.https://doi.org/10.1257/aer.102.6.2381.

Chen,Brian S,Samuel G Hanson,and Jeremy C Stein.2017.“The Decline of Big-Bank Lending to Small Business:Dynamic Impacts on Local Credit and Labor Markets.”Working Paper 23843.National Bureau of Economic Research.https://doi.org/10.3386/w23843.

Chodorow-Reich,Gabriel.2014.“Employment Effects of Credit Market Disruptions:Firm-Level Evidence from the 2008-9 Financial Crisis.”Quarterly Journal of Economics 129(1):1-59.

Christiano,Lawrence J.,Martin S.Eichenbaum,and Mathias Trabandt.2014.“Understanding the Great Recession.”American Economic Journal:Macroeconomics 7(1):110-67.

Clark,Tim P.,and Lisa H.Ryu.2015.“CCAR and Stress Testing as Complementary Supervisory Tools.”Board of Governors of the Federal Reserve System.June 24,2015.https://www.federalreserve.gov/bankinforeg/ccar-and-stress-testing-as-complementary-supervisory-tools.htm.

Cohen,Jon,Kinda Cheryl Hachem,and Gary Richardson.2018.“Relationship Lending and the Great Depression.”Working Paper 22891.National Bureau of Economic Research.https://doi.org/10.3386/w22891.

Copeland,Adam,Antoine Martin,and Michael Walker.2010.“The Tri-Party Repo Market Before the 2010 Reforms.”477.Federal Reserve Bank of New York Staff Reports.Federal Reserve Bank of New York.http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.363.5485&rep=rep1&type=pdf.

Cornett,Marcia Millon,Jamie John McNutt,Philip E.Strahan,and Hassan Tehranian.2011.“Liquidity Risk Management and Credit Supply in the Financial Crisis.”Journal of Financial Economics 101(2):297-312.https://doi.org/10.1016/j.jfineco.2011.03.001.

Correa,Ricardo,Horacio Sapriza,and Andrei Zlate.2013.“Liquidity Shocks,Dollar Funding Costs,and the Bank Lending Channel during the European Sovereign Crisis.”International Finance Discussion Papers 1059r(July).https://www.federalreserve.gov/pubs/ifdp/2012/1059/ifdp1059r.pdf.

Covitz,Daniel,Nellie Liang,and Gustavo A.Suarez.2013.“The Evolution of a Financial Crisis:Collapse of the Asset-Backed Commercial Paper Market.”Journal of Finance 68(3):815-48.

Covitz,Daniel M.,Nellie Liang,and Gustavo A.Suarez.2009.“The Evolution of a Financial Crisis:Panic in the Asset-Backed Commercial Paper Market.”2009-36.Finance and Economic Discussion Series.Washington DC:Federal Reserve Board.https://www.federalreserve.gov/pubs/feds/2009/200936/200936pap.pdf.

Dagher,Jihad,and Kazim Kazimov.2015.“Banks Liability Structure and Mortgage Lending During the Financial Crisis.”Journal of Financial Economics 116(3):565-82.https://doi.org/10.1016/j.jfineco.2015.02.001.

Dang,Tri Vi,Gary Gorton,and Holmstrom.2015.“The Information Sensitivity of a Security.”http://www.columbia.edu/~td2332/Paper_Sensitivity.pdf.

De Haas,Ralph,and Neeltje Van Horen.2012.“International Shock Transmission after the Lehman Brothers Collapse:Evidence from Syndicated Lending.”American Economic Review 102(3):231-37.https://doi.org/10.1257/aer.102.3.231.

Del Negro,Marco,Gauti Eggertsson,Andrea Ferrero,and Nobuhiro Kiyotaki.2017.“The Great Escape? A Quantitative Evaluation of the Feds Liquidity Facilities.”American Economic Review 107(3):824-57.https://doi.org/10.3386/w22259.

DellAriccia,Giovanni,Enrica Detragiache,and Raghuram Rajan.2005.“The Real Effect of Banking Crises.”Journal of Financial Intermediation 17(1):89-112.

Diamond,Douglas W.,and Philip H.Dybvig.1983.“Bank Runs,Deposit Insurance,and Liquidity.”Journal of Political Economy 91(3):401-19.

Drechsler,Itamar,Alexi Savov,and Philipp Schnabl.2018.“A Model of Monetary Policy and Risk Premia.”The Journal of Finance 73(1):317-73.https://doi.org/10.1111/jofi.12539.

Duchin,Ran,Oguzhan Ozbas,and Berk A.Sensoy.2010.“Costly External Finance,Corporate Investment,and the Subprime Mortgage Credit Crisis.”Journal of Financial Economics,The 2007-8 financial crisis:Lessons from corporate finance,97(3):418-35.https://doi.org/10.1016/j.jfineco.2009.12.008.

Duygan-Bump,Burcu,Alexey Lekov,and Judit Montoriol-Garriga.2015.“Financing Constraints and Unemployment:Evidence from the Great Recession.”Journal of Monetary Economics 75(October):89-105.

Duygan-Bump,Burcu,Patrick M.Parkinson,Eric S.Rosengren,Gustavo A.Suarez,and Paul S.Willen.2010.“How Effective Were the Federal Reserve Emergency Liquidity Facilities? Evidence from the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility.”QAU10-3.Federal Reserve Bank of Boston Working Paper.Federal Reserve Bank of Boston.https://www.bostonfed.org/publications/risk-and-policy-analysis/2010/how-effective-were-the-federal-reserve-emergency-liquidity-facilities-evidence-from-the-asset-backed-commercial-paper-money-market-mutual-fund-liquidity-facility.aspx.

Eggertsson,Gauti B.,and Paul Krugman.2012.“Debt,Deleveraging,and the Liquidity Trap:A Fisher-Minsky-Koo Approach*.”The Quarterly Journal of Economics 127(3):1469-1513.https://doi.org/10.1093/qje/qjs023.

Falato,Antonio,and Nellie Liang.2016.“Do Creditor Rights Increase Employment Risk? Evidence from Loan Covenants.”The Journal of Finance 71(6):2545-90.https://doi.org/10.1111/jofi.12435.

Favara,Giovanni,Simon Gilchrist,Kurt F.Lewis,and Egon Zakraj.ek.2016.“Updating the Recession Risk and the Excess Bond Premium,”FEDS Notes(blog).October 6,2016.https://www.federalreserve.gov/econresdata/notes/feds-notes/2016/updating-the-recession-risk-and-the-excess-bond-premium-20161006.html.

Favilukis,Jack,Sydney C Ludvigson,and Stijn Van Nieuwerburgh.2010.“The Macroeconomic Effects of Housing Wealth,Housing Finance,and Limited Risk-Sharing in General Equilibrium.”Working Paper 15988.National Bureau of Economic Research.https://doi.org/10.3386/w15988.

Fazzari,Steven M.,R.Glenn Hubbard,and Bruce C.Petersen.1988.“Financing Constraints and Corporate Investment.”Brookings Papers on Economic Activity 1988(1):141-206.https://doi.org/10.2307/2534426.

Fleming,Michael J.,Warren B.Hrung,and Frank M.Keane.2010.“Repo Market Effects of the Term Securities Lending Facility.”The American Economic Review 100(2):591-96.

Geanakoplos,John.2010.“The Leverage Cycle.”NBER Macroeconomics Annual 2009,Volume 24,April,1-65.

Gertler,Mark,and Simon Gilchrist.2018.“What Happened:Financial Factors in the Great Recession.”Working Paper 24746.National Bureau of Economic Research.https://doi.org/10.3386/w24746.

Gertler,Mark,and Peter Karadi.2011.“A Model of Unconventional Monetary Policy.”Journal of Monetary Economics 58(1):17-34.

Gertler,Mark,and Nobuhiro Kiyotaki.2015.“Banking,Liquidity,and Bank Runs in an Infinite Horizon Economy.”American Economic Review 105(7):2011-43.https://doi.org/10.1257/aer.20130665.

Gertler,Mark,Nobuhiro Kiyotaki,and Andrea Prestipino.2017.“A Macroeconomic Model with Financial Panics.”Working Paper 24126.National Bureau of Economic Research.https://doi.org/10.3386/w24126.

Gilchrist,Simon,Raphael Schoenle,Jae Sim,and Egon Zakraj.ek.2017.“Inflation Dynamics during the Financial Crisis.”American Economic Review 107(3):785-823.https://doi.org/10.1257/aer.20150248.

Gilchrist,Simon,and Egon Zakraj.ek.2012a.“Credit Spreads and Business Cycle Fluctuations.”

American Economic Review 102(4):1692-1720.https://doi.org/10.1257/aer.102.4.1692.——.2012b.“Credit Supply Shocks and Economic Activity in a Financial Accelerator Model.”Rethinking the Financial Crisis,Russel Sage Foundation.January.

Giroud,Xavier,and Holger M.Mueller.2017.“Firm Leverage,Consumer Demand,and Employment Losses During the Great Recession.”The Quarterly Journal of Economics 132(1):271-316.https://doi.org/10.1093/qje/qjw035.

Gissler,Stefan,and Borghan Narajabad.2017.“The Increased Role of the Federal Home Loan Bank System in Funding Markets,Part 1:Background.”FEDS Notes(blog).October 18,2017.https://www.federalreserve.gov/econres/notes/feds-notes/the-increased-role-of-the-federal-home-loan-bank-system-in-funding-markets-part-1-background-20171018.htm.

Goetz,Martin,and Juan Gozzi.2010.“Liquidity Shocks,Local Banks,and Economic Activity:Evidence from the 2007-2009 Crisis.”SSRN Scholarly Paper ID 1709677.Rochester,NY:Social Science Research Network.https://papers.ssrn.com/abstract=1709677.

Goldberg,Linda S.,Craig Kennedy,and Jason Miu.2011.“Central Bank Dollar Swap Lines and Overseas Dollar Funding Costs,”Forthcoming,Federal Reserve Bank of New York Economic Policy Review.”FRBNY Economic Policy Review.New York,New York:Federal Reserve Bank of New York.http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.422.11&rep=rep1&type=pdf.

Gorton,Gary B.2008.“The Subprime Panic.”Working Paper 14398.National Bureau of Economic Research.http://www.nber.org/papers/w14398.pdf.

Gorton,Gary B.,and Andrew Metrick.2012a.“Securitized Banking and the Run on Repo.”Journal of Financial Economics 104(3):425-51.

——.2012b.“Who Ran on Repo?”Working Paper 18455.National Bureau of Economic Research.http://www.nber.org/papers/w18455.pdf.

Gorton,Gary,and George Pennacchi.1990.“Financial Intermediaries and Liquidity Creation.”

The Journal of Finance 45(1):49-71.https://doi.org/10.2307/2328809.

Greenspan,Alan.2005.“Reflections on Central Banking.”Speech presented at the Jackson Hole Economic Policy Symposium,Jackson Hole,Wyoming,August 26.https://www.kansascityfed.org/publicat/sympos/2005/pdf/Green-opening2005.pdf.

Guerrieri,Luca,and Matteo Iacoviello.2017.“Collateral Constraints and Macroeconomic Asymmetries.”Journal of Monetary Economics 90(October):28-49.

Hall,Robert E.2010.“Why Does the Economy Fall to Pieces after a Financial Crisis?”Journal of Economic Perspectives 24(4):3-20.https://doi.org/10.1257/jep.24.4.3.

——.2011.“The High Sensitivity of Economic Activity to Financial Frictions.”The Economic Journal 121(552):351-78.https://doi.org/10.1111/j.1468-0297.2011.02421.x.

Haltenhof,Samuel,Seung Jung Lee,and Viktors Stebunovs.2014.“The Credit Crunch and Fall in Employment during the Great Recession.”Journal of Economic Dynamics and Control 43(June):31-57.

Hancock,Diana,and Wayne Passmore.2010.“Did the Federal Reserves MBS Purchase Program Lower Mortgage Rates?”Finance and Economics Discussion Series 2011(01).https://www.federalreserve.gov/pubs/feds/2011/201101/201101pap.pdf.

Hanson,Samuel,and Adi Sunderam.2013.“Are There Too Many Safe Securities? Securitization and the Incentives for Information Production.”Journal of Financial Economics 108(3):565-84.

Hatzius,Jan.2008.“Beyond Leveraged Losses:The Balance Sheet Effects of the Home Price Downturn.”Brookings Papers on Economic Activity 2008(2):195-228.

He,Zhiguo,In Gu Khang,and Arvind Krishnamurthy.2010.“Balance Sheet Adjustments in the 2008 Crisis.”Working Paper 15919.National Bureau of Economic Research.https://doi.org/10.3386/w15919.

Huber,Kilian.2018.“Disentangling the Effects of a Banking Crisis:Evidence from German Firms and Counties.”American Economic Review 108(3):868-98.https://doi.org/10.1257/aer.20161534.

Iacoviello,Matteo.2014.“Financial Business Cycles.”Review of Economic Dynamics 18(1):140-63.

Irani,Rustom M.,and Ralf R.Meisenzahl.2014.“Loan Sales and Bank Liquidity Risk Management:Evidence from a U.S.Credit Register.”Finance and Economics Discussion Series 2015(001).https://www.federalreserve.gov/econresdata/feds/2015/files/2015001pap.pdf.

Ivashina,Victoria,and David Scharfstein.2009.“Bank Lending During the Financial Crisis of 2008.”Journal of Financial Economics 97(2010).

Iyer,Rajkamal,Samuel Lopes,Jose-Luis Peydro,and Antoinette Schoar.2014.“Interbank Liquidity Crunch and the Firm Credit Crunch:Evidence from the 2007-2009 Crisis.”The Oxford University P 27(1).https://papers.ssrn.com/abstract=2263025.

Jensen,Thais Lrkholm,and Niels Johannesen.2017.“The Consumption Effects of the 2007–2008 Financial Crisis:Evidence from Households in Denmark.”American Economic Review 107(11):3386-3414.https://doi.org/10.1257/aer.20151497.

Jermann,Urban,and Vincenzo Quadrini.2012.“Macroeconomic Effects of Financial Shocks.”American Economic Review 102(1):238-71.https://doi.org/10.1257/aer.102.1.238.

Jones,Callum,Virgiliu Midrigan,and Thomas Philippon.2018.“Household Leverage and the Recession.”Working Paper 16965.National Bureau of Economic Research.https://doi.org/10.3386/w16965.

Jordà,scar,Moritz Schularick,and Alan M.Taylor.2016.“Macrofinancial History and the New Business Cycle Facts.”Working Paper 22743.National Bureau of Economic Research.https://doi.org/10.3386/w22743.

Juselius,Mikael,and Mathias Drehmann.2015.“Leverage Dynamics and the Real Burden of Debt.”501.BIS Working Papers.Bank of International Settlements.https://www.bis.org/publ/work501.htm.

Kacperczyk,Marcin,and Philipp Schnabl.2010.“When Safe Proved Risky:Commerical Paper during the Financial Crisis of 2007-2009.”Journal of Economic Perspectives 24(1):29-50.

Kahle,Kathleen M.,and René M.Stulz.2013.“Access to Capital,Investment,and the Financial Crisis.”Journal of Financial Economics 110(2):280-99.https://doi.org/10.1016/j.jfineco.2013.02.014.

Kandrac,John.2014.“Bank Failure,Relationship Lending,and Local Economic Performance.”Finance and Economics Discussion Series 2014(41).https://www.federalreserve.gov/pubs/feds/2014/201441/201441pap.pdf.

Kaplan,Greg,Kurt Mitman,and Giovanni L.Violante.2016.“Non-Durable Consumption and Housing Net Worth in the Great Recession:Evidence from Easily Accessible Data.”Working Paper 22232.National Bureau of Economic Research.https://doi.org/10.3386/w22232.

Kashyap,Anil,Jeremy C.Stein,and David W Wilcox.1993.“Monetary Policy and Credit Conditions:Evidence from the Composition of External Finance.”American Economic Review 83(1):78-98.

Keane,Frank M.n.d.“Securities Loans Collateralized by Cash:Reinvestment Risk,Run Risk,and Incentive Issues.”Current Issues in Economics and Finance 19(3).Accessed August 20,2018.https://www.newyorkfed.org/medialibrary/media/research/current_issues/ci19-3.pdf.

Kennickell,Arthur B.,Myron L.Kwast,and Jonathan Pogach.2015.“Small Businesses and Small Business Finance during the Financial Crisis and the Great Recession:New Evidence From the Survey of Consumer Finances.”Finance and Economics Discussion Series 2015(039).https://www.federalreserve.gov/econresdata/feds/2015/files/2015039pap.pdf.

Kiyotaki,Nobuhiro,and John Moore.1997.“Credit Cycles.”Journal of Political Economy 105(2):211-48.https://doi.org/10.1086/262072.

Kohn,Donald,and Brian Sack.2018.“Monetary Policy During the Financial Crisis,”September(forthcoming).

Krishnamurthy,Arvind.2010.“Amplification Mechanisms in Liquidity Crises.”American Economic Journal Macroeconomics(2):1-30.

Laeven,Luc,and Fabian Valencia.2013.“The Real Effects of Financial Sector Interventions during Crises.”Journal of Money,Credit and Banking 45(1):147-77.

Levin,Andrew T.,Fabio M.Natalucci,and Egon Zakraj.ek.2004.“The Magnitude and Cyclical Behavior of Financial Market Frictions.”2004-70.Finance and Economic Discussion Series.Federal Reserve Board of Governors.https://www.federalreserve.gov/pubs/feds/2004/200470/200470pap.pdf.

Logan,Lorie,William Nelson,and Patrick Parkinson.2018.“Novel Lender-of-Last Resort Programs,”September(forthcoming).

Longstaff,Francis A.2010.“The Subprime Credit Crisis and Contagion in Financial Markets.”Journal of Financial Economics,The 2007-8 financial crisis:Lessons from corporate finance,97(3):436-50.https://doi.org/10.1016/j.jfineco.2010.01.002.

Mach,Traci L.,and John D.Wolken.2012.“Examining the Impact of Credit Access on Small Firm Survivability.”Finance and Economics Discussion Series 2012(10).https://www.federalreserve.gov/pubs/feds/2012/201210/201210pap.pdf.

Manconi,Alberto,Massimo Massa,and Ayako Yasuda.2012.“The Role of Institutional Investors in Propagating the Crisis of 2007-2008.”Journal of Financial Economics,Market Institutions,Financial Market Risks and Financial Crisis,104(3):491-518.https://doi.org/10.1016/j.jfineco.2011.05.011.

McAndrews,James,Asani Sarkar,and Zhenyu Wang.2017.“The Effect of the Term Auction Facility on the London Interbank Offered Rate.”Journal of Banking & Finance 83(October):135-52.

McCabe,Patrick E.2010.“The Cross Section of Money Market Fund Risks and Financial Crises.”Finance and Economic Discussion Series.Federal Reserve Board of Governors.

Merton,Robert C.1974.“On the Pricing of Corporate Debt:The Risk Structure of Interest Rates.”The Journal of Finance 29(2):449-70.https://doi.org/10.2307/2978814.

Mian,Atif R.,Amir Sufi,and Emil Verner.2017.“Household Debt and Business Cycles Worldwide.”SSRN Scholarly Paper ID 2655804.Rochester,NY:Social Science Research Network.https://papers.ssrn.com/abstract=2655804.

Mian,Atif,Kamalesh Rao,and Amir Sufi.2013.“Household Balance Sheets,Consumption,and the Economic Slump.”The Quarterly Journal of Economics 128(4):1687-1726.https://doi.org/10.1093/qje/qjt020.

Mian,Atif,and Amir Sufi.2018a.“Finance and Business Cycles:The Credit-Driven Household Demand Channel.”Working Paper 24322.National Bureau of Economic Research.https://doi.org/10.3386/w24322.

——.2018b.“Credit Supply and Housing Speculation.”Working Paper 24823.National Bureau of Economic Research.https://doi.org/10.3386/w24823..

——.2010.“Household Leverage and the Recession of 2007 to 2009.”IMF Economic Review 58(1):74-117.https://doi.org/10.3386/w15896.

——.2014a.House of Debt.First.Chicago:University of Chicago Press.https://www.press.uchicago.edu/ucp/books/book/chicago/H/bo20832545.html.

——.2014b.“What Explains the 2007-2009 Drop in Employment?”Econometrica 82(6):2197-2223.

Mishkin,Frederic S.2011.“Over the Cliff:From the Subprime to the Global Financial Crisis.”Journal of Economic Perspectives 25(1):49-70.https://doi.org/10.1257/jep.25.1.49.

Mitchener,Kris James,and Gary Richardson.2016.“Network Contagion and Interbank Amplification during the Great Depression.”Working Paper 22074.National Bureau of Economic Research.https://doi.org/10.3386/w22074.

Morgan,Donald P.,Stavros Peristiani,and Vanessa Savino.2014.“The Information Value of the Stress Test.”Journal of Money,Credit and Banking 46(7):1479-1500.

Nolan,Charles,and Christoph Thoenissen.2009.“Financial Shocks and the US Business Cycle.”Journal of Monetary Economics 56(4):596-604.

Peek,Joe,and Eric Rosengren.2016.“Credit Supply Disruptions:From Credit Crunches to Financial Crisis.”SSRN Scholarly Paper ID 2870864.Rochester,NY:Social Science Research Network.https://papers.ssrn.com/abstract=2870864.

——.2000.“Collateral Damage:Effects of the Japanese Bank Crisis on Real Activity in the United States.”American Economic Review 90(1):30-45.https://doi.org/10.1257/aer.90.1.30.

Puri,Manju,Jrg Rocholl,and Sascha Steffen.2011.“Global Retail Lending in the Aftermath of the US Financial Crisis:Distinguishing Between Supply and Demand Effects.”Journal of Financial Economics 100(3):556-78.https://doi.org/10.1016/j.jfineco.2010.12.001.

Rajan,Raghuram G.2005.“Has Financial Development Made the World Riskier?”Working Paper 11728.National Bureau of Economic Research.https://doi.org/10.3386/w11728.

Ramcharan,Rodney,Skander Van den Heuvel,and Stephane H.Verani.2016.“From Wall Street to Main Street:The Impact of the Financial Crisis on Consumer Credit Supply.”The Journal of Finance 71(3):1323-56.

Ramcharan,Rodney,and Raghuram Rajan.2014.“Financial Fire Sales:Evidence from Bank Failures.”Finance and Economics Discussion Series 2014(67).https://www.federalreserve.gov/pubs/feds/2014/201467/201467pap.pdf.

Reinhart,Carmen M.,and Kenneth S.Rogoff.2009.This Time Is Different:Eight Centuries of Financial Folly.Princeton:Princeton University Press.

Rose,Jonathan.2015.“Old-Fashioned Deposit Runs.”SSRN Scholarly Paper ID 2705730.Rochester,NY:Social Science Research Network.https://papers.ssrn.com/abstract=2705730.

Sahm,Claudia R.,Matthew D.Shapiro,and Joel Slemrod.2015.“Balance-Sheet Households and Fiscal Stimulus:Lessons from the Payroll Tax Cut and Its Expiration.”Finance and Economics Discussion Series 2015(037).https://www.federalreserve.gov/econresdata/feds/2015/files/2015037pap.pdf.

Santos,Joo A.C.2011.“Bank Corporate Loan Pricing Following the Subprime Crisis.”The Review of Financial Studies 24(6):1916-43.https://doi.org/10.1093/rfs/hhq115.

Sarkar,Asani,and Jeffrey Shrader.“Financial Amplification Mechanisms and the Federal Reserves Supply of Liquidity during the Crisis.”Federal Reserve Bank of New York Staff Reports 431(March 2010).https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr431.pdf.

Schroth,Enrique,Gustavo A.Suarez,and Lucian A.Taylor.2014.“Dynamic Debt Runs and Financial Fragility:Evidence from the 2007 ABCP Crisis.”Journal of Financial Economics 112(2):164-89.https://doi.org/10.1016/j.jfineco.2014.01.002.

Scott,Hal S.2016.Connectedness and Contagion:Protecting the Financial System from Panics.Cambridge,MA:The MIT Press.

Shiller,Robert J.2007.“Understanding Recent Trends in House Prices and Homeownership.”In Housing,Housing Finance,and Monetary Policy.Jackson Hole,Wyoming.https://www.kansascityfed.org/publicat/sympos/2007/PDF/Shiller_0415.pdf.

Shin,Hyun Song.2011.“Global Banking Glut and Loan Risk Premium.”In Mundell-Fleming Lecture.Washington DC:International Monetary Fund.https://www.imf.org/external/np/res/seminars/2011/arc/pdf/hss.pdf.

Shleifer,Andrei,and Robert Vishny.2010.“Asset Fire Sales and Credit Easing.”American Economic Review Papers and Proceedings 100(2):46-50.

Siemer,Michael.2014.“Firm Entry and Employment Dynamics in the Great Recession.”Finance and Economics Discussion Series 2014(56).https://www.federalreserve.gov/pubs/feds/2014/201456/201456pap.pdf.

Stock,James H.,and Mark W.Watson.2012.“Disentangling the Channels of the 2007-09 Recession.”Brookings Papers on Economic Activity 2012(1):81-156.

Sunderam,Adi.2015.“Money Creation and the Shadow Banking System.”The Review of Financial Studies 28(4):939-77.https://doi.org/10.1093/rfs/hhu083.

Van den Heuvel,Skander.2002.“Does Bank Capital Matter for Monetary Transmission?”Economic Policy Review,no.May:259-65.

Woodford,Michael.2010.“Financial Intermediation and Macroeconomic Analysis.”Journal of Economic Perspectives 24(4):21-44.https://doi.org/10.1257/jep.24.4.21.

Wu,Tao.2008.“On the Effectiveness of the Federal Reserves New Liquidity Facilities.”Federal Reserve Bank of Dallas Working Paper 2008(8).https://www.dallasfed.org/~/media/documents/research/papers/2008/wp0808.pdf.

Zhang,Lu,Arzu Uluc,and Dirk Bezemer.2017.“Did Pre-Crisis Mortgage Lending Limit Post-Crisis Corporate Lending? Evidence from UK Bank Balance Sheets.”Bank of England Staff Working Paper 651(March).http://www.bankofengland.co.uk/research/Pages/workingpapers/2017/swp651.aspx.

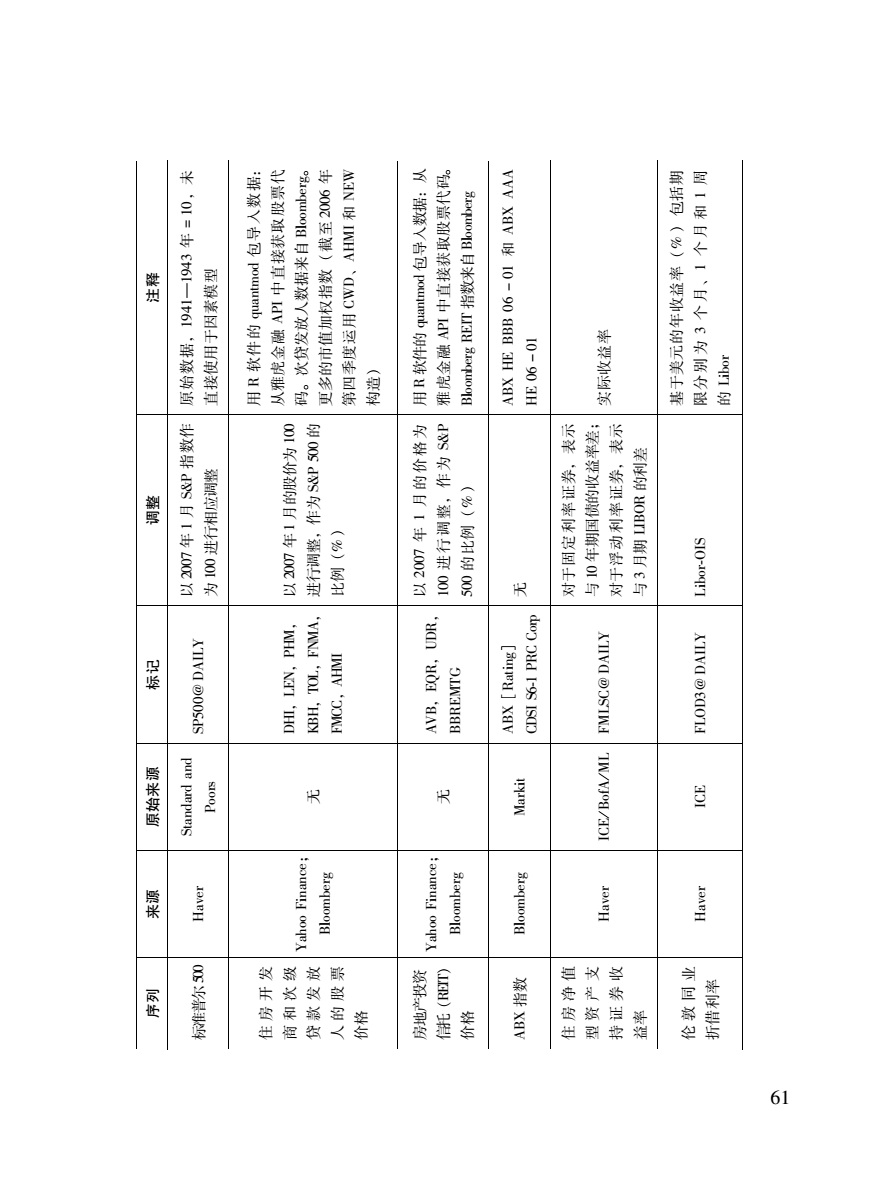

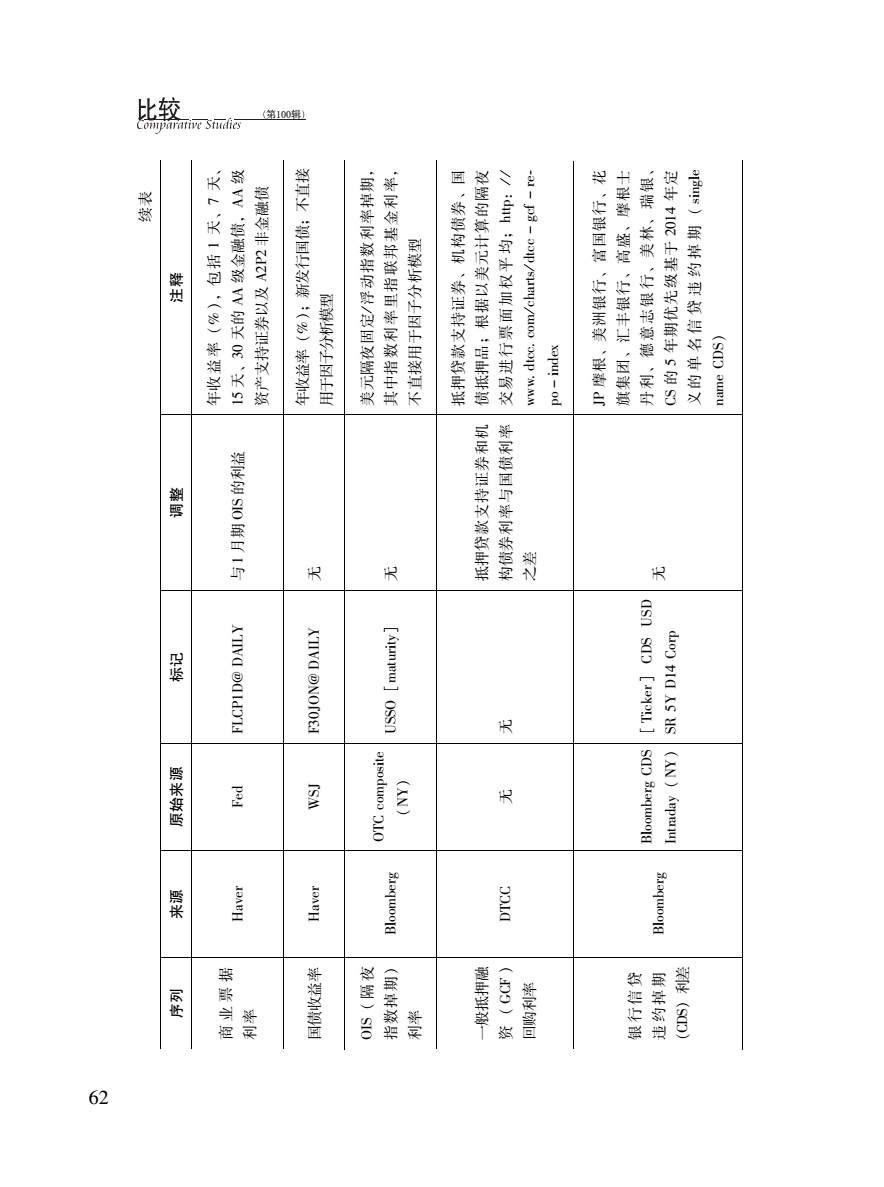

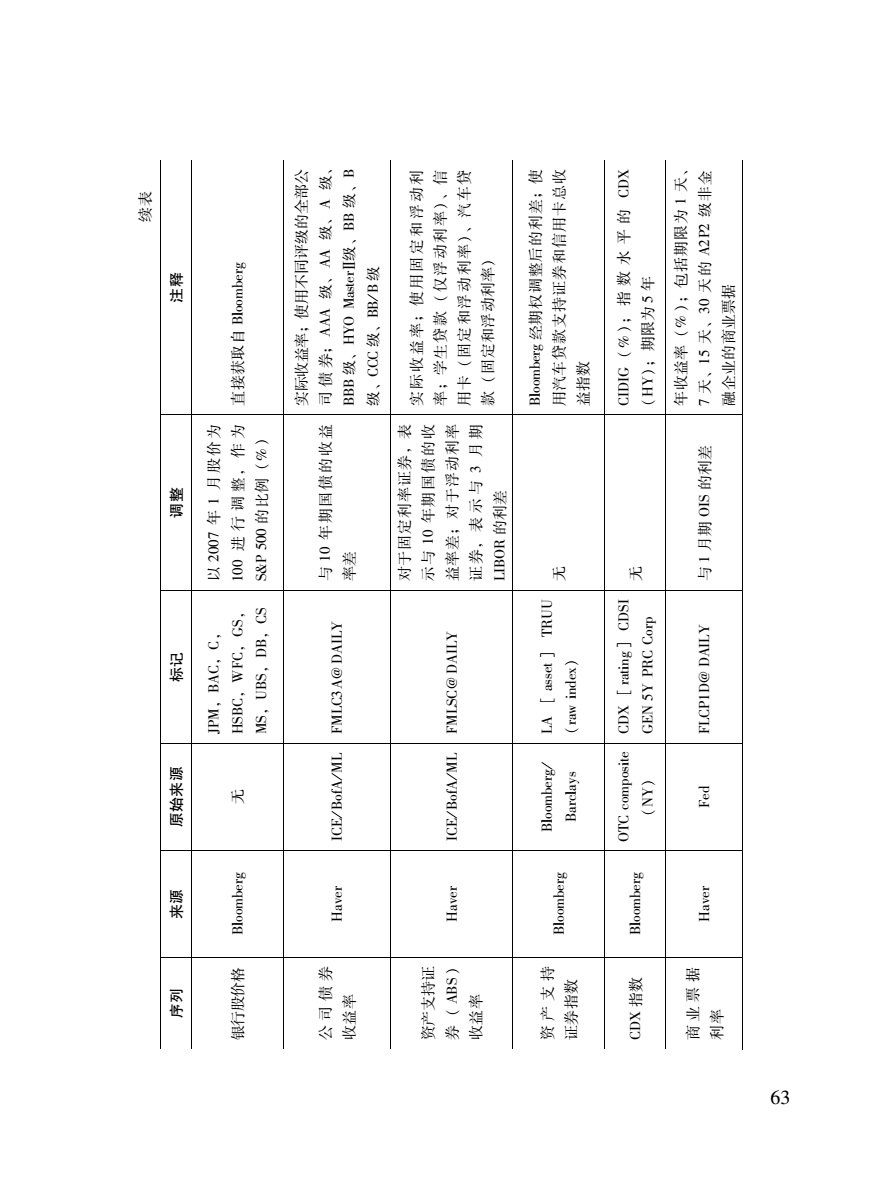

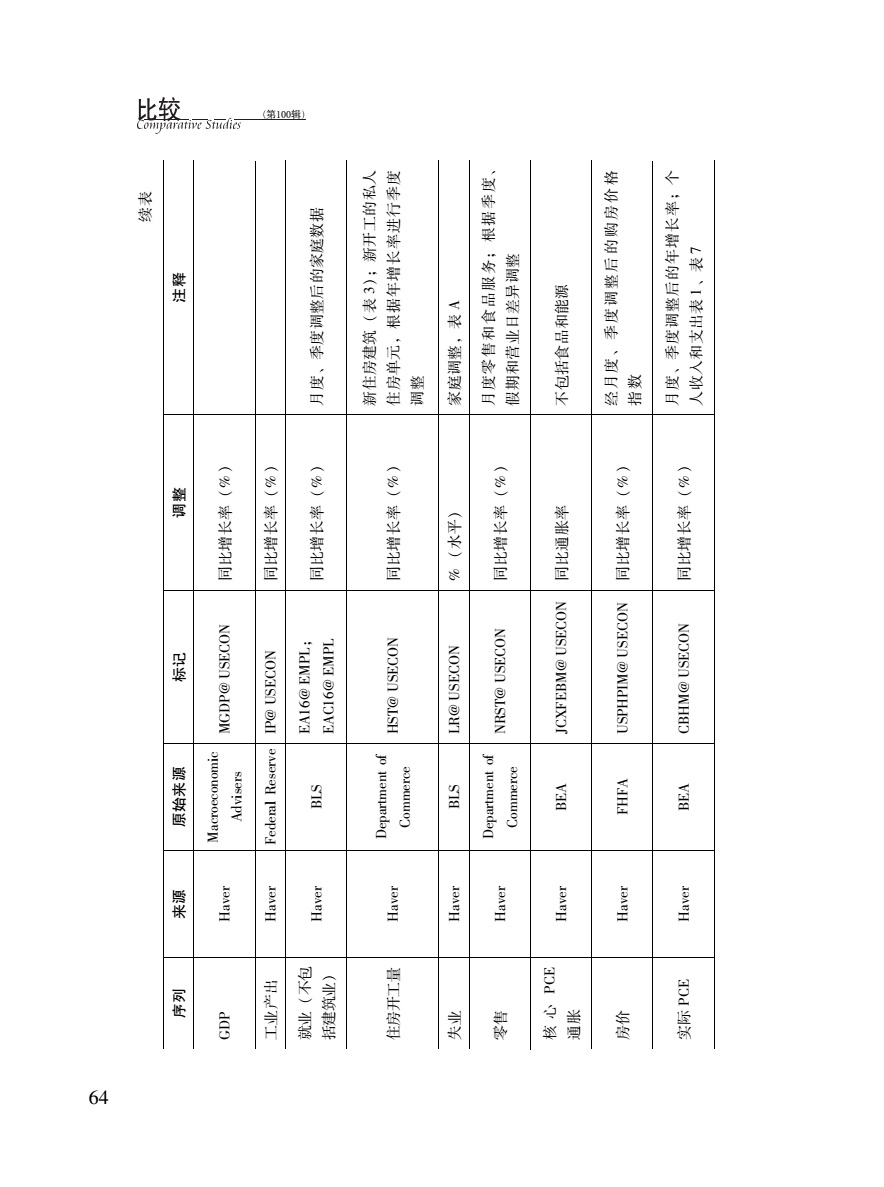

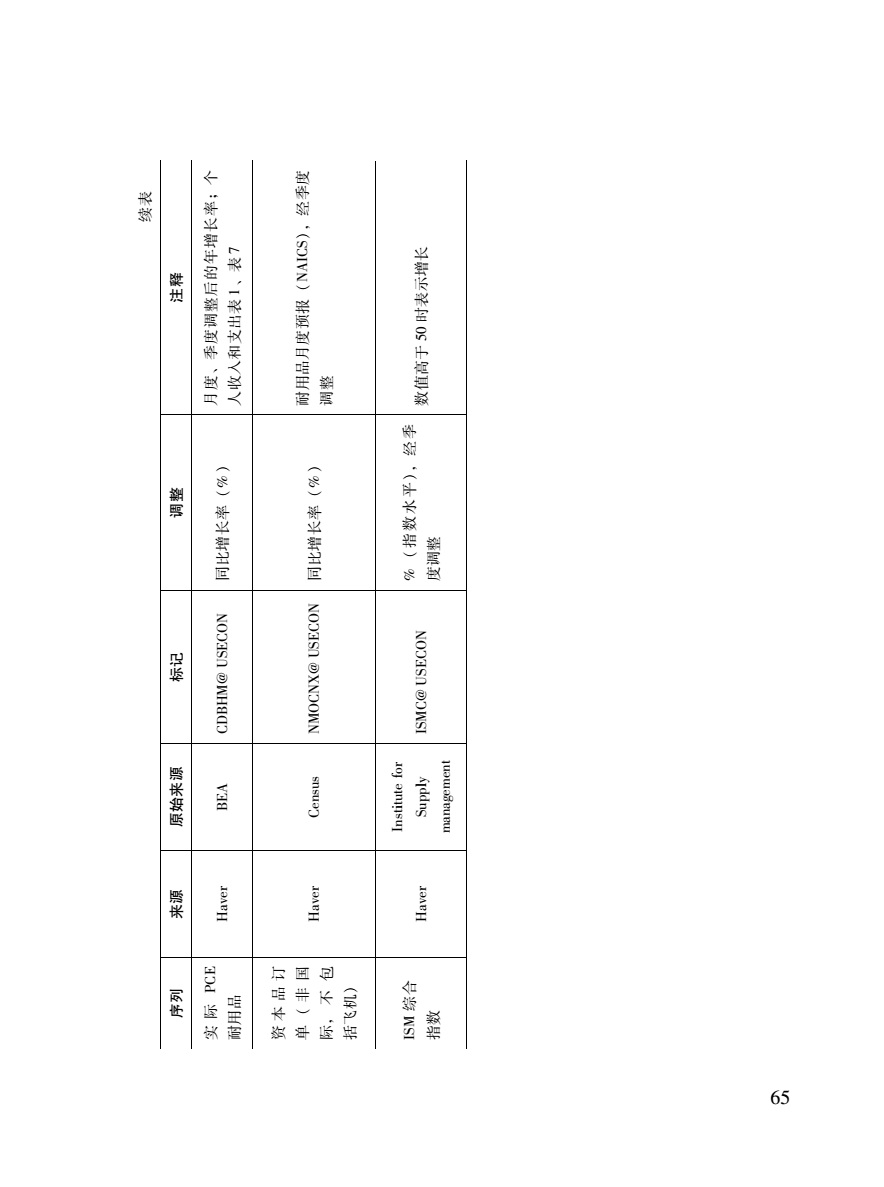

数据附录

因子模型的数据是每日数据(不包含假日),并前推了缺失值。回购协议数据的季度末日期由前一日的数值代替,以控制虚假价格。模型中用到的所有数据都对2006—2012年做了标准化。因子分析利用正交旋转估计了四个因子,最优化的唯一性的下限值为0.05。究竟发生了什么?

|

|

|

|

|

|

京公网安备 11010502034662号

京公网安备 11010502034662号